Current Ratio Higher or Lower Better

Current Ratio Current Asset Current Liabilities. The higher the ratio the more liquid the company is.

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Ratio_Jul_2020-02-8806530bcda84b2b9cb3218413e8a417.jpg)

Current Ratio Explained With Formula And Examples

This article uses data from the Current Population Survey to examine the state of the US.

/dotdash_Final_Current_Ratio_Jul_2020-01-2261aa1f53a947508e23a4b93b350cdb.jpg)

. Many investors first action when looking at potential or current stocks is to look at their current trading price and past performance followed by the price-to-earnings PE ratio. Mortality in the most affected countries. As pixel density becomes higher and higher the noticeable benefits of that higher pixel density become lower and lower.

A good mortgage rate is considered 075 to 1 lower than your current rate. While generally speaking a higher pixel density is better there is a point of diminishing returns. Women fared mildly better.

The current rate for a 15-year fixed-rate mortgage is 516 with 08 points paid 018 percentage points higher week-over-week. While the unemployment rate among women peaked at 90 percent in November 2010. Commonly acceptable current ratio is 2.

Acceptable current ratios vary from industry to industry. But for the most part lower ratios tend to reflect higher-performing businesses. It is crucial for determining a companys financial health.

For the twenty countries currently most affected by COVID-19 worldwide the bars in the chart below show the number of deaths either per 100 confirmed cases observed case-fatality ratio or per 100000 population this represents a countrys general population with both confirmed cases and healthy people. In exchange for the lower monthly payments though rates for a 30-year refinance will typically be higher than 15-year and 10-year refinance rates. What is a good expense ratio for a mutual fund.

Even as small and medium enterprises listed on the two SME exchanges in the country BSE SME and NSE Emerge have better profitability ratios higher return on assets. A ratio of 01 indicates that a business has virtually no debt relative to equity and a ratio of 10 means a companys. In general a current ratio of 2 means that a companys current assets are two times higher than its current liabilities and is considered healthy.

Therefore the higher the CASA ratio the better the net interest margin which means better operating efficiency of. By cutting on down the weight of a car car makers can increase the speed and performance of their supercars. Short-term loans have higher monthly payments but lower.

The unemployment rate for men reached 111 percent in October 2009. Furthermore a higher Quick ratio determines better liquidity and financial health. It must mean that most the current assets The Current Assets Current assets refer to those short-term assets which can be efficiently utilized for business operations sold for immediate cash or liquidated within a year.

Whereas a lower quick ratio. From the above-calculated data we analyzed that the quick ratio has fallen from 17 in 2011 to 06 in 2015. Youll also pay off your loan slower.

The 15-year rate averaged 219 a year ago this week. ETFs usually have a lower expense ratio than pure mutual funds. Expense Ratio of more than 15 is considered to be very high from an investors point of view.

The formula to calculate Current Ratio is as given below. Power-to-weight ratio is equal to thrust per unit mass multiplied by the velocity of any vehicle. The price-earnings ratio PE ratio is the ratio for valuing a company that measures its current share price relative to its per-share earnings.

As the examples above show a low current ratio could spell trouble for your business. It is generally understood that a higher current account and savings account ratio leads to higher net interest income because the interest paid on CASA deposits is lower than on term deposits hence the NII tends to be higher. To gauge this ability the current ratio considers the current.

But when it comes to evaluating your companys ability to pay off short-term debts is higher always better. 05 to 075 Expense Ratio for an actively managed portfolio is considered to be a good one and beneficial for the investors. If you really want to know how fast a car is you need to know the power to weight ratio the higher the number is the better.

As a general rule of thumb businesses should aim for a current ratio higher than one. Credit and Finance for MSMEs. This will eventually lead to a point where the benefits offered by a higher pixel density are undetectable by your eye.

If the trailing PE ratio is higher than the. It comprises inventory cash cash equivalents. Youll get a better rate when the LTV is below 80.

Current ratio is a measurement of a companys ability to pay back its short-term obligations and liabilities. For most industrial companies 15 may be an acceptable current ratio. For instance with the debt-to-equity ratio arguably the most prominent financial leverage equation you want your ratio to be below 10.

What Is a Good Current Ratio Working Capital Ratio. Quick Ratio defines a companys ability to meet its short-term debt obligations with its most liquid assets. Its a comfortable financial position for most enterprises.

Low values for the current ratio values less than 1 indicate. If a trailing PE ratio is lower than a forward PE ratio it means analysts on bearish on the company. Labor market 10 years after the start of the Great Recession of 200709.

The current ratio is a liquidity ratio that measures a companys ability to pay short-term and long-term obligations. Price-Earnings Ratio - PE Ratio.

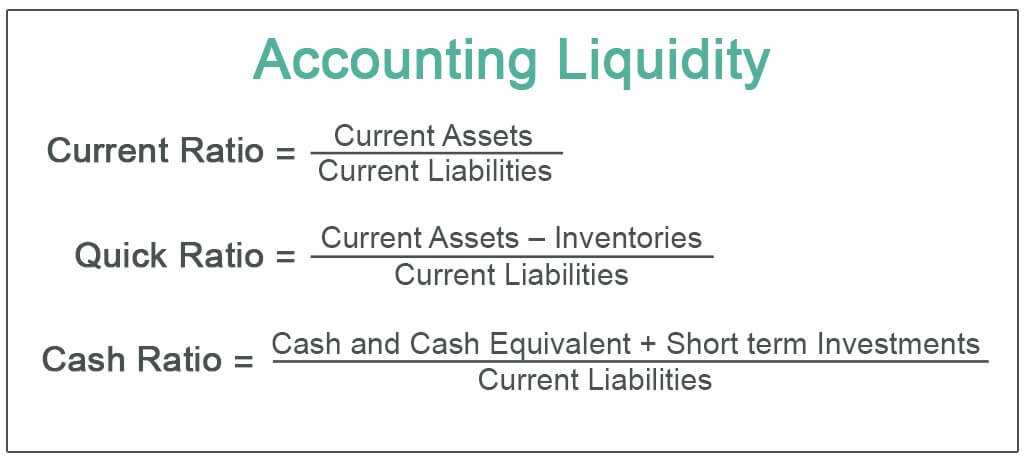

Accounting Liquidity Definition Formula Top 3 Accounting Liquidity Ratio

Acid Test Ratio Vs Current Ratio Formula Comparison Excel Template

/dotdash_Final_Current_Ratio_Jul_2020-01-2261aa1f53a947508e23a4b93b350cdb.jpg)

Current Ratio Explained With Formula And Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Ratio_Jul_2020-01-2261aa1f53a947508e23a4b93b350cdb.jpg)

Current Ratio Explained With Formula And Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Ratio_Jul_2020-03-54eeb2ed66a546ad8c2f1e5e86366170.jpg)

Current Ratio Explained With Formula And Examples

/dotdash_Final_Current_Ratio_Jul_2020-01-2261aa1f53a947508e23a4b93b350cdb.jpg)

Current Ratio Explained With Formula And Examples

0 Response to "Current Ratio Higher or Lower Better"

Post a Comment